Customer Lifetime Value

The Key

Customer lifetime value the key to understanding how much to invest into customer retention. Here we cover "How do you value a customer's lifetime?” This is a need to know tool. This article covers LTV (Lifetime Value) and much more. Plus you can download a free spreadsheet for calculating LTV, see below.

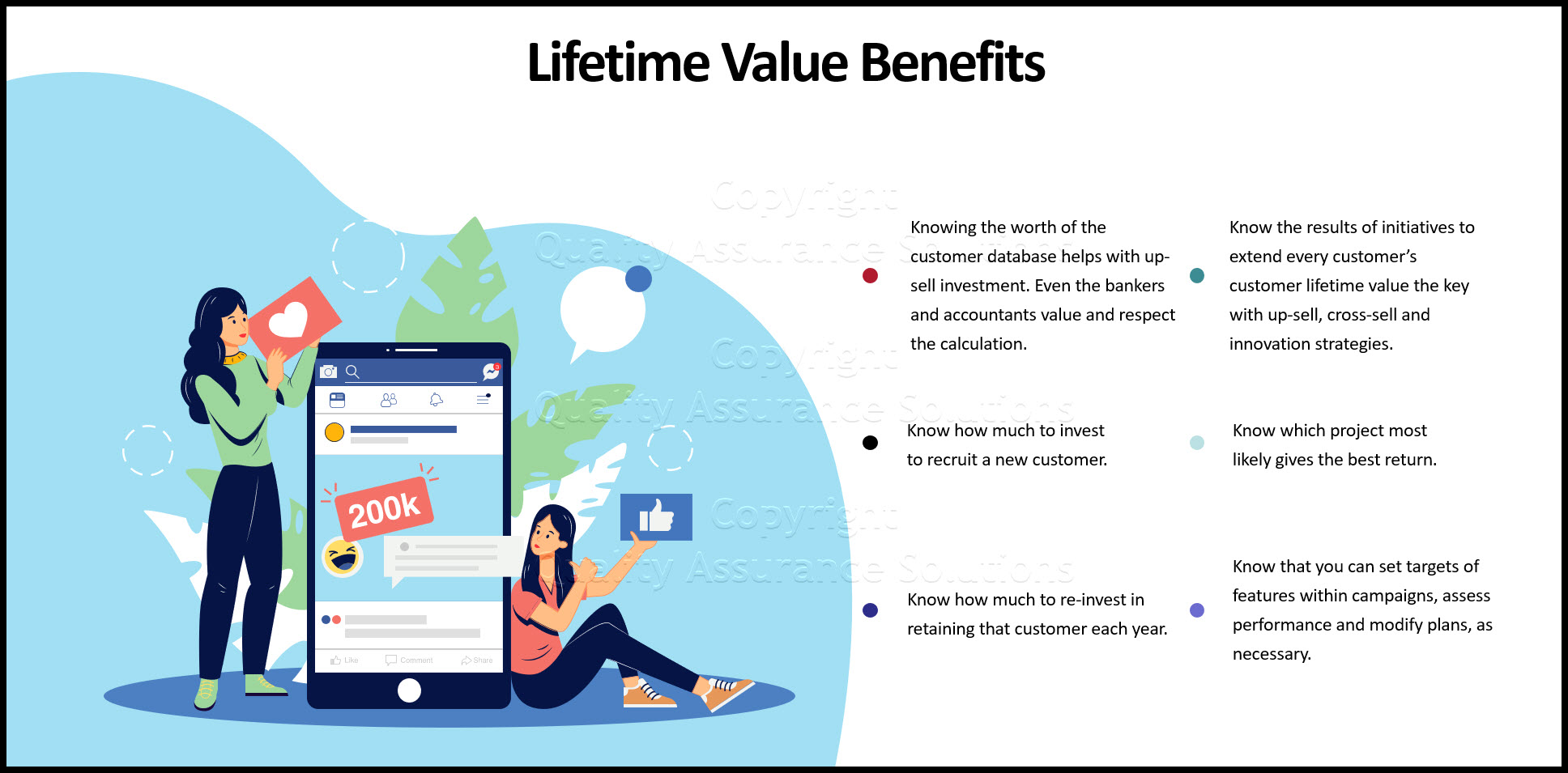

Reasons to Know LTV

1. To know the worth of my customer database should I want to up-sell. Even the bankers and accountants value and respect the calculation.

2. To know how much to invest to recruit a new customer. With enough data, to determine the medium or channel to use.

I know of major airlines who willingly spend $2-3,000 to get a prospect into the top tier of their loyalty scheme. Those individuals buy tickets in excess of $200,000 in ticket sales over their ‘lifetime’.

3. To know how much to re-invest in retaining that customer each year.

To illustrate customer lifetime value the key, major catalogue companies can forecast to the penny how much they must pay to incentivize repeat sales.

4. To know the results of initiatives to extend every customer’s customer lifetime value the key with up-sell, cross-sell and innovation strategies.

5. To know which project most likely gives the best return. Management must make choices; choosing the route with the greatest potential for financial success makes sense to me.

Creating simple LTV models enabled us to prioritize the available options.

6. To know that I can set targets of features within campaigns, assess performance and modify plans as necessary. Plus, with a spreadsheet plan, you can ask ‘what if’ questions to aid decisions at all times.

TrainingKeeper Software. Keep, organize and plan all your employees' training and activities. Software includes multi-user support with reports, certs, and calendars.

ROI vs LTV

Are we talking about return on investment (ROI)?

Isn’t that something accountants handle?

Two questions, two answers – both are “No”.

OK, there some similarities between LTV and ROI. They examined how money changes in value over time and uses the same arithmetical formula to calculate it. [The calculation can seem too complicated for many people]

More particularly, ROI versus LTV is an issue of focus and use. ROI covers any project of any kind that involves the allocation of resources for any member of the management team. LTV, customer lifetime value the key, focuses on people; our customers, who they are, where we find them, how we get them to spend money, for how long and the costs of doing all this… while making a profit.

So No it’s not something for accountants to handle – they don’t know their customers. Marketing, sales staff, and small-business owners uses customer lifetime value the key.

Handling Inflation

Money really does change in value.

It’s called inflation – if we leave aside international exchange rates.

Let me give you a simple analogy. Say that last year a loaf of bread cost $1 and this year $1.10, the loaf hasn’t changed but the price has gone up 10p. Money has lost 10% in value from the first year to the next.

This is important because we can’t compare money amounts over 2, 3 or more years with discounting for inflation. And this is the norm in the customer lifetime value the key calculations. One client of mine had an LTV of 25 years.

Just think how the price of his bread might have changed from year 1 to year 25!

This Data Analysis Video teaches you the basic tools for understanding, summarizing, and making future predictions with your collected data. Includes MS Excel templates.

Example of a Simple LTV

Suppose you sold an electronic gadget that normally retails at $50. It costs you $20 to buy. When someone purchases that gadget, you make a gross profit of $30.

Having purchased that one item you keep the customer informed of similar products. They buy another piece of equipment at $150, which costs you $80 to buy. That gives you $70 profit.

So far, you’ve made $100. Now, let’s say he purchases an item for $230, which costs you $110 to buy in. That’s another $120 to add to your GP (gross profit) from that one customer.

Suppose he only buys one more item from you at $320, which costs you $180 at source. This adds another $140 in GP profit. Your overall GP from that customer’s four transactions is now:

$30 + $70 + $120 + $140 = $360.

Now that you have this information you can make an educated decision on how you can encourage a prospect’s first purchase. In fact, you could afford to offer the first electronic gadget at a ridiculously low price, i.e. cost or even just below, knowing that your follow-up marketing methods encourage more sales on which you can make additional profits.

So, if you offered your gadget at $21 instead of $50 as a ‘special offer’ you could have a higher number of people purchasing than you would if you tried to retain your profit margin on the first sale.

Arguably, this simple LTV calculation is sufficient if you maintain the same strategy year on year. However, it’s not really precise enough in a dynamic environment for business people like us.

The majority of the value in your customer is in the sales after their initial purchase.

Most business owners and managers know this. I’m sure you do. However, few people really appreciate the life time value of their customers.

When you know the true life time value (and profitability) of your average customer then you know how much you can afford to spend on marketing or special offers in order to attract the first purchase.

Now you have this information you can make an educated decision on how you encourage the first purchase. In fact, you could afford to offer your first electronic gadget at a ridiculously low price, i.e. cost or even below; knowing your marketing method - regular, informative contact - encourages more sales on which you can make your profit.

So, if you offer your first gadget at $30 instead of $50 as a ‘special offer’ you probably have a higher response of people purchasing than you would if you tried to retain your profit margin on the first sale.

Don’t forget, it’s the follow-up nurturing that creates your full life time value.

The thing is, would you rather have 20 sales at $30 with the likelihood of further purchases creating a good gross profit for you? Or just 3 sales at $50 and no follow-on sales?

If you have never done this exercise before, I strongly recommend that you do so, before you start any marketing campaigns.

8D Manager Software with 8D, 9D, 5Y and 4M report generator. Your corrective action software for managing, measuring, and reporting issues.

Why Customer Lifetime Value The Key?

First, we are talking about customers and the length of time that they buy from us before they stop. That period, be it 1 year or 25 years, is their lifetime.

Let me expand on that. No individual will continue to buy from you. Your customers will fall away year on year until you have too few for planning purposes. I set that minimum at no less than 10% of the original volume, unless dealing with mega databases.

We call this ‘retention rate’. That’s the proportion of the customers who continue buying year after year after year. If you have 3,000 customers at the end of year 1 and 1,890 buy again in year 2 you have a retention rate of 63%. Obviously, you want to use tactics that increase that retention rate to as near to 100% as possible.

So the length of a customer's lifetime is dependent upon the retention rate – sometimes also called the ‘churn rate’. So again you may ask, “Just how long is that lifetime?” Customer lifetime value the key helps determines this.

When you begin to build your permission database* you don’t know the length of your customer lifetime. There is no magic formula to tell you. Experienced marketers have data to analyze that gives them a clear guide to a precise estimate; for the rest of us, we have to estimate based on experience.

[* Permission means you are legally entitled to market to your customers until they or you decide to stop. I also use ‘database’ rather than ‘list’. A list has contact details. A database has so much more e.g. transactional histories, profiles of behavioral data, channels used and more that help us to market to them with knowledge of their wants and needs.]

A retention rate of 50% is common. It’s not a certainty as I’ve seen both stronger and weaker rates. This is just a fair estimate to use. If you do the math, you’ll find that between years 4 – 5 your database falls below the 10% limit described above. For the sake of simplicity, the average person on your database probably buys from you for an average of 2½ years.

To calculate customer lifetime value the key, however, we consider the actual customers, their actual cash transactions and the actual number of years they continue to buy.

Your ISO 9001:2015 Kit includes Templates, QA Manual, Implementation Guide and a Gap Assessment Internal Audit Tool for ISO 9001:2015

Does that mean riches to rags in 2½ years?

No! We were only looking at your customers at the end of year 1. In year 2 you attract more customers, and in year 3 more… and so on. They haven’t been included in the calculations – yet.

As your business continues you re-evaluate lifetime and customer lifetime value the key estimates, establish your own retention rate and improve the quality of your analysis.

Let’s look at improving the quality of customer lifetime value the key, as your basic knowledge grows.

1. Not all of your customers are the same. Gender could be important or age or life-stage or geography or any of many profiling characteristics.

2. Not all of the items they buy are the same. Some buy the same product or selection of products each time; others buy across the range and do not repeat purchases or upsell or cross-sell between ranges.

3. Not all of the prices they pay are the same. Some may favor special deals, others unit price yet more buy in volumes only.

4. Not all of your customers have the same buying pattern. Some buy annually, others irregularly or seasonally.

5. Not all of your customers are individuals. If you’re fortunate to have business or public organization buyers as well as individuals, you have yet more to consider.

You can’t be expected to know any of this when you begin trading. Your previous experience may give you a head start as to the buying characteristics of your customer lifetime value the key, but you can’t be sure, and you won’t have worthwhile numbers for some time.

So don’t let this customer lifetime value the key checklist overwhelm you, just be aware that the data you gather becomes more useful over time.

Download Your Master Files

Please download the Customer Lifetime Value The Key Spreadsheets in a zip file by signing up for QA Solutions E-zine. Inside is a PDF containing this article and two Excel spreadsheets; one is a ‘master template’ that does most of the work for you.

It isn’t complete until you input your own data. You can’t be expected to know any of this when you begin selling. Your

previous experience may give you a head start as to the buying

characteristics of your customer lifetime value the key, but you can’t

be sure, and you won’t have worthwhile numbers for some time.

The spreadsheet does hard work for you by the formulas it contains.

The other spreadsheet is a working example for you to study.

Working the Master Spreadsheet

Here you have a basic checklist of the factors that you may want to include in your own customer lifetime value the key model. Where these factors have a cost, the more precise your definition, the more accurate your LTV model.

You can add or delete data rows above the ‘Total’ without affecting the formula.

The important idea to remember, include consistent elements so all versions can be comparative. For example, if you have a telephone response option, then including those costs in one version and not in another affects the end result. Any comparison between those results is not viable.

When calculating the customer lifetime value the key, you don’t need to go overboard in the costs you include. You’ll have set your product prices to cover your overheads so there’s no need to consider them.

What must be included are the extra costs associated with the specific segment you model. Examples include the costs of recruitment, subsequent costs of communication and handling promotional costs. But you would not include discounts as you already accounted for these in the sales value.

There’s one factor that is a bit more of a challenge to deal with. You’ll remember that earlier I wrote about needing to account for inflation. You do this by by applying a discount rate but, where do you get this from? Some will try to tell you that the discount rate equals the prevailing interest rate. It’s not!

If you had to borrow the money, you’d pay a bank’s lending rate, but that’s only a start. You also need to allow for risk and more which I would need another course to describe.

So use these ‘rules of experience' – if the bank rate is:

- less than 5% use a discount rate of 10%

- from 5- 10% double it to establish the discount rate

- over 10% add another 10%

- if it is over 10%… then god help us!

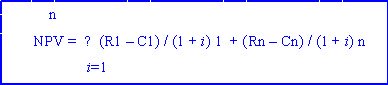

The major formula in the spreadsheet is shown below and it’s not that simple to understand! That’s why the worksheet takes care of the mathematics for you.

But there are two issues with this formula of much greater relevance:

1. You want tools to help you make better decisions. You don’t want to become a mathematician. This LTV model is one of the most useful marketing tools you can use.

2. The formula gives you a single figure result. In the example spreadsheet I’ve given the Customer LTV is £98.22 based on net cumulative sales over 5 years. When we refine the calculation based on profit earned over 5 years the Customer LTV is £39.29. Of course those are results we set out to establish but they hide too much essential information.

Get Green Belt Certified with this extensive on-line course. Learn the Six Sigma tools and steps. Earn 25 PMI PDU. Start implementing Six Sigma today

Example Spreadsheet

When you look at the example spreadsheet, you’ll see the impact of the retention rate on the decline in the customer numbers year on year. This may be a factor that you may not have appreciated in hard numbers before. And there’s much more to review besides.

Run spreadsheet tests to examine what you would need to do to increase Customer Lifetime Values. If you use realistic alternatives and the results are positive, then you have removed some of the risk before you organize a live test.

Please go through the spreadsheets to familiarize yourself with the information they reveal. There’ll be a surprise or two for you. I’m sure.

Article written by Terry Savage,

BA, DipM, FCIM, FIDM, FISMM, AMRS, Cert Accy

Article edited and posted by Quality Assurance Solutions

- QAS Home

- LTV

|

Quality Assurance Solutions Robert Broughton (805) 419-3344 USA |

|

|

Software, Videos, Manuals, On-Line Certifications | ||

|

450+ Editable Slides with support links | ||

|

Corrective Action Software | ||

|

Plan and Track Training | ||

|

AQL Inspection Software |

|

Learn and Train TRIZ | ||

|

Editable Template | ||

|

Templates, Guides, QA Manual, Audit Checklists | ||

|

EMS Manual, Procedures, Forms, Examples, Audits, Videos | ||

|

On-Line Accredited Certifications Six Sigma, Risk Management, SCRUM | ||

|

Software, Videos, Manuals, On-Line Certifications |